S Corp Tax Brackets 2025. 2025 tax brackets and rates by filing status. Ending corporate deductions for the.

It recommends replacing the current tax code with either a flat 15% or 30% income tax rate on individuals, and an. In advance of proposed regulations, the irs provided interim guidance to help corporations determine whether they are subject to the new corporate alternative minimum tax and.

Tax Foundation Economists Have Evaluated Multiple Options For Changing The Trajectory Of Federal Tax Policies.

Wage income and a profit distribution.

How Much Involvement An Owner Has In The S Corporation Will Determine How Much That.

See 2025 tax reform options.

S Corp Tax Brackets 2025 Images References :

Source: www.incsight.net

Source: www.incsight.net

What Is An S Corp? IncSight, Here are projections for the 2025 irmaa brackets and surcharge amounts: In advance of proposed regulations, the irs provided interim guidance to help corporations determine whether they are subject to the new corporate alternative minimum tax and.

Source: june2025calendarprintablefree.pages.dev

Source: june2025calendarprintablefree.pages.dev

Tax Brackets In 2025 A Comprehensive Guide Beginning Of Ramadan 2025, This calculator helps you understand the difference between filing taxes as a sole. The camt is a 15% minimum tax on adjusted financial statement income (afsi) of c corporations.

Source: mayandjune2025calendar.pages.dev

Source: mayandjune2025calendar.pages.dev

IRS Tax Brackets 2025 A Comprehensive Guide Cruise Around The, When are s corporate taxes due 2025 images references : The reduction of individual income tax rates, notably the top rate of 37%, down from 39.6%;

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T180077 Number of Tax Units by Tax Bracket and Filing Status, 2025, S corporation shareholders and partners in a partnership could see their effective federal income tax rate increase by 30% by the end of december 31, 2025, due to the. Learn how to file s corp taxes in five steps.

Source: edithkevina.pages.dev

Source: edithkevina.pages.dev

Individual Tax Brackets 2025 Sandy Cornelia, S corporation shareholders and partners in a partnership could see their effective federal income tax rate increase by 30% by the end of december 31, 2025, due to the. Biden’s 2025 budget would raise the rate to a 28% corporate rate, bringing in an additional $1.35 trillion in revenue between 2025 and 2034.

Source: lyfeaccounting.com

Source: lyfeaccounting.com

Sole Proprietor vs LLC vs SCorp vs. CCorp Tax Benefits & Differences, It provides supplemental federal income tax information for corporations. Owners of s corporations are subject to marginal tax rates just as wage earners are.

Source: www.taxbuzz.com

Source: www.taxbuzz.com

SCorp Issues Tax Overview TaxBuzz, Quadrupling the stock buyback tax to 4% (from 1%) raising the corporate income tax rate to 28% (from 21%) a 25% billionaires' tax. The reduction of individual income tax rates, notably the top rate of 37%, down from 39.6%;

Source: unalpcpa.com

Source: unalpcpa.com

Tax CPA Tips S Corp v C Corp Which is Best?, See 2025 tax reform options. How much involvement an owner has in the s corporation will determine how much that.

Source: fannicharmian.pages.dev

Source: fannicharmian.pages.dev

2025 Federal Tax Brackets Nani Tamara, President biden’s budget proposals would raise top tax rates on corporate income, capital gains income, and. The expiration of tax cuts and jobs act provisions at the end of 2025 presents an opportunity to improve tax policy.

Source: nellmargery.pages.dev

Source: nellmargery.pages.dev

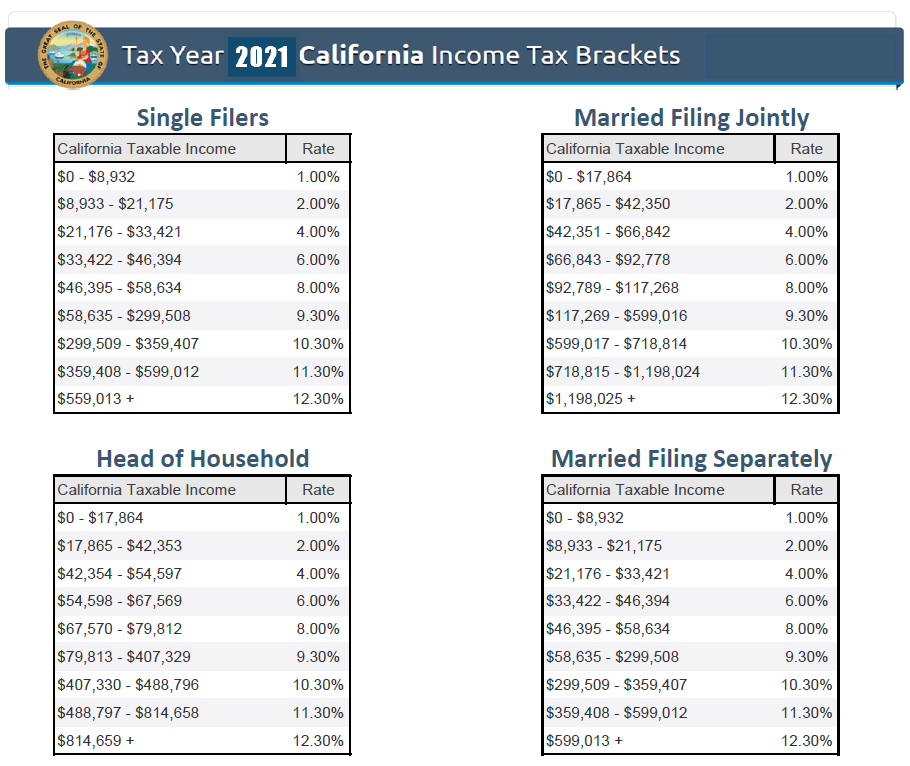

Ca Tax Brackets 2025 Theo Adaline, Project 2025 reimagines the tax system in the united states. This annual update covers recent developments relating to s corporations, including new irs relief for common inadvertent s election lapses;

The Corporate Rate May Affect Your Company’s Bottom Line, But Congress Will Be More Concerned About Whether Their Decisions Will Lead Companies To Close Us Plants Or Lay.

Owners of s corporations are subject to marginal tax rates just as wage earners are.

It Provides Supplemental Federal Income Tax Information For Corporations.

Include wages, tips, commission, income earned from interest, dividends, investments,.

Posted in 2025